Rebuttal/Opinion by Linda Dean Cooper

This is my rebuttal to Property Appraiser Jason Whistler’s FB comment that all packing sheds are treated equally. They are not.

Below is Whistler’s comment on Spotlight on Levy County Government FB page, May 8, 2025.

“All packing sheds are treated equally. They are assessed on a square foot basis. Mills shed is assessed at $106,019. Etheridge is assessed at $141,402 (the highest of the group plus that is not taking into account the value that we have the office appraised at, which they are paying special assessments on) Harper is assessed at $66,483. Tillis packing shed, assessed at $114,372 has a land use code of “packing shed” because that piece doesn’t have Ag on it like the other 3 parcels do and it is in the city limits. The other 3 you mentioned are coded as “pasture land” because that is what they are. The land use code does not determine the value that we place on the packing sheds.”

Whistler’s statement that “all packing sheds are treated equally” and that “the land use code does not determine the value that we place on the packing sheds” is false and fails to acknowledge the real issue: the inconsistent and preferential treatment of certain property owners based on selective classification of land, not buildings a clear violation of Florida law and administrative code.

Land Valuation Is the Problem – Not Building Square Footage

You attempt to shift the focus to the building valuations by claiming they are assessed “on a square foot basis,” but that is not the dispute. The core issue is how the land beneath those buildings is classified and valued. It is that classification, not the square footage of the structure, that dramatically affects overall assessments and tax obligations.

Classification Examples:

- Tillis Packing Shed, labeled as a “packing plant,” receives no agricultural exemption and is assessed at $30,960 per acre.

- Mills Packing Shed, doing the same thing, is labeled a “loading shed” and receives full agricultural classification for the land underneath, valued at only $340.63 per acre.

- Etheridge’s facility is also labeled a “loading shed,” receives agricultural classification, and is assessed at $252 per acre.

- Eddie Hodge’s Packing Shed, like Tillis, is labeled a “packing plant,” receives no exemption, and is assessed at $24,000 per acre.

- Woodrow Fugate & Sons Peanut Sheller is stripped of its agricultural exemption on an acre and labeled as “food processing,” with a land value of $27,995 per acre, but all the surrounding property is agricultural.

- Jeff Phillips’ massive packing shed is called a pole barn by the property appraiser. Again, the value of the land under the packing shed is “ pasture” with a valuation of $252 per acre

Not Fair and Equal Treatment by Appraiser Whistler

Whistlers’ mixed bag of varied classifications is not equal treatment. The activity in each of those buildings are functionally identical, agricultural packaging and handling, yet you arbitrarily assign different labels to justify selective classification. You’re calling one a “loading shed” and giving it a massive tax break while calling the same structure elsewhere a “packing plant” or “food processing” and stripping it of agricultural use.

Whistler’s Application of 12D-5.001(1) Is Arbitrary & Irregular

You appear to invoke F.A.C. 12D-5.001(1), which excludes industrial processing (like canning factories) from agricultural classification. But you don’t apply this standard consistently:

- Woodrow Fugate loses his ag classification because you label his facility “food processing.”

- Mills and Etheridge perform the same type of ag handling, but are still treated as pasture with ag exemption and extremely low land values.

Your assessment of Fugate vs Mills and Ethridge proves two things:

First, your reasoning is not applied evenly.

Second, your classification system is based on favoritism, not law.

If Fugate’s sheller is “processing,” so are Mills’ and Etheridge’s sheds. If Mills and Etheridge qualify for ag classification, why not Fugate? You cannot selectively apply the exemption based on who owns the facility or what label you feel like assigning it.

PA Whistler Using His Office to Pick Winners and Losers?

You are not treating these operations equally. You are manipulating labels to deliver favorable treatment to some and punitive assessments to others. That’s not a lawful appraisal. This is you as a constitutionally elected Levy Property Appraiser picking winners and losers at your discretion. It’s political discretion masquerading as administration.

This violates the principle of fair and equal taxation and is a breach of your duties under § 193.461 and F.A.C. 12D-5.003.

It’s Time to Restructure and Eventually Eliminate Property Taxes

Republican Rep. Ryan Chamberlin is pushing to restructure and eventually eliminate the most hated tax in America – Property Tax. Seniors who have paid on their property for 30, 40, or even 50 years, and they still don’t own it.

The government says it wants affordable housing. But that’s a lie. Taxes continue to rise to pay for the government’s bloated tax and spending policies. Add the greedy, self-serving insurance companies, and the American dream of home ownership is out of reach. If Florida believes in “Save our Homes” show me!

Florida Lottery: 25 Cents of Every Dollar Spent Goes to Education- Not Good Enough

The Florida Lottery was pitched to the voters in 1988, that its proceeds were to enhance public education in Florida. I paid $455.81 in school taxes on a small vacant property. I am retired, with no children in school, and on a fixed income. I pay another $594.83 for school taxes on my homestead property next door. Governor DeSantis and Rep Ryan Chamberlin should review the lottery payout and how it is used. Shift the burden of school assessments and school resource officers to be taken from Florida Lottery proceeds would be a good first step.

Start now to reduce property taxes by paying for schools and mandatory, unfunded school resource officers in our schools with lottery money. We voted for the lottery for tax relief and more money for our schools. Not a slush fund government overspending.

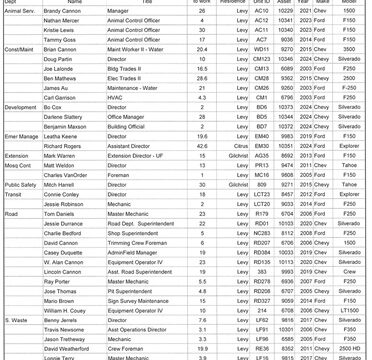

The budget process has started in Levy. Citizens, be prepared for an increase in EMS, Fire, and landfill assessments. At the last BoCC meeting, Commissioner Tim Hodge mentioned the county workers’ discontent with the high cost of county health insurance. Hodge said the workers want the county to contribute more, or they may leave.

There is a lot of fat to be trimmed from Levy County Government. Support property tax reform. The inconsistency in assessing property, along with special exemptions for special groups, needs to end. Anyone with budget, property tax suggestions, or a letter to the editor, send them to Spotlight email @ spotlightlevycountygovernment@gmail.com.

This quote is often attributed to Thomas Jefferson: “If serving in an elected office ever becomes a career, corruption will surely follow.”

——————–

Posted May 15, 2025