By Terry Witt – Spotlight Senior Reporter

Levy County Commission Chairman Matt Brooks averted a major blunder in Tuesday’s public hearing on adoption of the county’s tentative 9 mill tax rate when the mistake was caught by Commissioner John Meeks and corrected by the county attorney before it was etched into the history books.

Commissioners met in a public hearing before their regularly scheduled meeting to adopt the tentative 9 mill rate and tentative budget of $155.3 million, but for reasons unknown Brooks decided the required public hearings for the millage and budget weren’t necessary.

After discussing the proposed millage and noting he had received no additional comments or questions from the board, Brooks asked for a motion to approve the millage without first opening the floor to public comments as part of a public hearing.

Meeks leaned forward to quietly tell Brooks a public hearing was needed before they could move forward with a motion on the millage. Brooks asked County Attorney Nicolle Shalley if a public hearing was really needed.

“Alright, Miss Shalley, we’re not doing this in a public hearing format correct, for the tentative millage hearing? This will be moved forward by a simple motion and second,” Brooks said.

“I would do a public hearing for it,” Shalley responded with a surprised look.

Brooks reversed course, opened the public hearing, and asked for comments from the public on the proposed millage. There were none. A motion by Meeks to approve the millage passed 4-0 with Commissioner Desiree Mills absent. Commissioners also approved the tentative budget 4-0 by a separate motion.

The budget process winds down quickly at this time of year when two public hearings are held in September to take comments from residents and commissioners. This particular hearing was to adopt the tentative millage. A second public hearing in the same meeting was for adoption of the tentative budget. Brooks allowed for both public hearings after being told by the county attorney the public hearings were necessary.

Public hearings give taxpayers a chance to comment on how their tax dollars are being spent. The final two public hearings in September aren’t optional. They are mandated by state law. The public hearing process must be followed even if there is no one in the audience who might want to comment. In this instance, the auditorium where commissioners meet was basically empty except for resident Sally Collins and a couple of public officials.

It was unclear why an experienced commissioner like Brooks would think he could skip the public hearing process.

The irony of this blunder is that followed another one at an Aug. 1 workshop when commissioners voted to approve motions to adopt the tentative millage of 9 mills and tentative budget of $155.3 million. The county approved a set of rules for conducting workshops and hearings in April. The commission is prohibited from voting on any official business in workshops. Their only job in that particular workshop was to give guidance to staff on the tentative millage and budget to be voted on at the Sept. 5 public hearing. But then Brooks tried to skip the public hearings on Tuesday.

Shonna McLean, a budget analyst who assembled the county budget this year for commissioners, said the 9 mills tentatively adopted by commissioners is actually the same tax rate the board has used for many years but it was in reality a 9.67 percent increase in taxes. That’s because the 9 mills will generate additional revenue next year from property value increases. Commissioners could have adopted a lower millage rate (the rollback rate) to give back those increased revenues to taxpayers but they chose instead to keep the 9 mills to fund operating expenses.

McLean said the reason for keeping the 9-mill rate was because of increases in wages for county commission employees, and employees of the sheriff, property appraiser, tax collector, clerk, and supervisor of elections. She said the increased wages were driven by inflation pressures, strains on providing services, and by the increase in the minimum wage approved statewide by voters.

Commissioner Rock Meeks reminded the board that it has kept the 9-mill property tax rate for about eight years.

“I feel we’re doing a good job of keeping the millage rate the same and making do with what we got,” Meeks said.

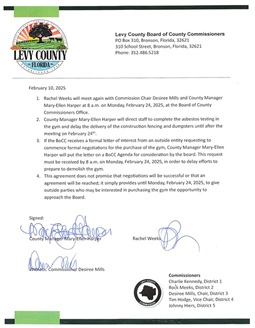

Brooks said the commission could have chosen the rollback rate but with the $8 million radio system the board is purchasing for public safety without state funding, and other financial pressures, it didn’t adopt the lower rate. He agreed that holding the line on the millage for nearly eight years “is pretty good and we have a much better financial picture than we did eight years ago as well.”

The board used COVID-19 funding from Congress to purchase the $8 million radio system. The funding was provided to local governments to help them emerge from the COVID-19 economic shutdown without excessive financial hardship. The board knew the radio system purchase was coming and set aside the COVID money for that purpose.

Commissioners over the years have used special assessments – also known as non-ad valorem taxation – to tamp down pressure on the millage rate. The county levies special assessments to fund landfill, fire, and EMS. The special assessments have helped the county avoid increases in the millage rate. The ad valorem and non-ad valorem taxes are added together to give the final tax bill that is owed.

There were a couple of missteps in the development of the budget. McLean said someone pointed out to her that a $400,000 grant was placed in the wrong line item of the budget. She said it will be moved to its correct location and won’t change the budget totals. It was just a clerical error.

She said $61,000 for three-line items was accidentally left out of the budget. She moved money out of reserves to make the budget balance. The money that was left out of the budget was for use in the parks budget.

Commissioners thanked McLean for her good work and eye for detail in finding the problems and correcting them. When the board adopted the tentative budget, the changes were included in an amendment to the spending plan.

The final budget hearing is in two weeks. Commissioners can lower the millage rate but they can’t raise it.

—————

Budget Public Hearing September 5, 2023; Posted September 6, 2023