By Terry Witt – Spotlight Senior Reporter

Chiefland City Commissioners battled for nearly an hour Monday night at their final budget hearing of the year before adopting a 2022-23 budget of just over $6 million, and a property tax rate of 8.55 mills, higher than last year.

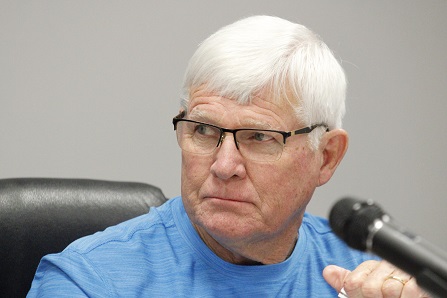

A verbal fight erupted when Commissioner Rollin Hudson refused to support the original plan to adopt a property tax rate of 8.73 mills, an increase of 17.9 percent over the previous year.

The board eventually decided, with Hudson’s consent, to reduce the size of the tax rate increase to 15.5 percent. The vote was 5-0 to approve the budget and millage for next year.

An across-the-board employee pay raise of $4 per hour increased expenditures for next year to the point where taxes had to be increased to support the bigger payroll.

Hudson wanted to trim fat from the budget, but he wasn’t willing to cut into the pay hike, nor were the other commissioners, due to the inflation rate and the need to retain experienced employees in a hot job market.

Commissioners also voted to increase the city’s fire tax from $129 to $159 to help city fire department operations. The fire tax is a special assessment that will appear on city property bills along with the higher millage rate.

The new budget year begins on Oct. 1. Some commissioners, and City Manager Laura Cain, were aggravated that Hudson waited until the final hearing to refuse to support a 17.9 percent property tax rate hike. A unanimous vote was needed.

“No disrespect, but I wish this had been brought up at the last meeting. I would have tweaked the numbers…,” Cain said.

“I didn’t pray about it at the last meeting. I did last night,” responded Hudson.

The compromise resulted after Hudson made the offer to vote for the budget if $30,000 was shaved off, which allowed the tax increase to be reduced by 15.5 percent.

“Would you do $30,000 if you could find some way to do it, or are you going to be so mad at me and never talk to me,” Hudson said to Cain.

“I’m mad. I’m not going to lie. I’m pretty ticked off,” Cain said. “You’re my boss, I’ll do whatever you want me to.”

Commissioner Lewrissa Johns wasn’t happy about the $30,000 offer from Hudson.

“We’re going to re-do a budget for $30,000? That’s why I’m kind of wondering,” Johns said.

“I think that’s nickel and diming, but whatever,” Cain added.

Hudson responded quickly.

“Alright then, we’ll do it at $90,000. How about that. Can we go do it that way?” he said.

He was referring to the $92,000 of additional revenue that was added to the budget when the original 8.73 mill tax rate was proposed. He was offering to cut spending by $30,000 to balance the budget at the lower rate.

“I’ll do it at 90 if that’s what you want me to do, I’ll do it. Just tell me,” Cain said.

“Guess what, I pay taxes in this town too and I’ve been paying a lot longer than you have. I’m getting mad too,” Hudson responded.

Johns felt Hudson’s comments came too late in the budget season.

“I just wonder why we weren’t talking about this at the last meeting. We could have had plenty of other meetings for us to bring it back, and now we’re where we’re at, it won’t go through. I’m aggravated,” she said.

City Attorney Blake Fugate reminded the board that the budget and final millage would have to be approved before Oct. 3 to meet the state’s deadlines, or at the very latest by Oct. 6.

At that point, Cain suggested a way of cutting next year’s budget to make the millage meet Hudson’s compromise proposal.

Cain’s solution was to take $30,000 out of the cash reserves that were being carried forward from the current budget into the 2022-23 budget year. Shrinking next year’s budget meant the millage rate didn’t have to generate those additional dollars and could be reduced by 15.5 percent.

The city’s cash reserves will remain at about $2 million in the 2022-23 budget. Commissioners were unwilling to touch the reserves to make the budget numbers balance out. The reserves are kept for emergencies.

City officials are concerned that gas prices could shoot skyward after the November congressional elections, depending on which party takes control of the country. Democrats currently control both houses of Congress and the White House. Gas, diesel, natural gas, and food prices remain high.

The board voted for a final millage of 8.5493 mills and a final budget of $6,044,349.

———————————–

——————————–

City of Chiefland Regular Meeting September 26, 2022; Posted October 1, 2022