Terry Witt – Spotlight Senior Reporter

Chiefland City Commissioners got their first look at their upcoming budget Monday with City Manager Laura Cain proposing a $1.35 per hour increase in pay for all employees in next year’s budget. The new budget starts on Oct. 1.

Cain wants to keep the property tax rate at 7.9075 mills, identical to last year and the year before. The millage will generate an additional $80,000 in tax revenue.

She estimated the raise would cost the city about $100,000. The proposed raise was her first discussion of city employee pay as the board enters discussion of its budget for the year 2021-22.

Cain told commissioners she believes the city must prepare for the increase in minimum wage approved by voters in a statewide constitutional amendment election. The minimum wage will rise to $10 per hour on Sept. 30, to $11 an hour a year from now until it reaches $15 an hour in four years.

Cain sees the employee pay raise as a first step in keeping pace with the rising minimum wage. She anticipates the city will continue with a similar pay raise in the 2022 budget and beyond until the $15 mark is reached.

“What if we can’t afford it?” said Commissioner Norman Weaver.

While it’s true that local governments will be forced to absorb the minimum wage increases, Cain said local businesses will also get hit with an increase in the cost of operating as a result of paying higher wages.

“I think when people were voting for this – certainly I don’t think anyone should have to live on minimum wage, how can you live on minimum wage these days – but at the same time when you start raising the minimum wage to $15 an hour and you have to pay your employee $15 an hour, what are you doing to the price of a gallon of milk, or a hamburger or pizza. What’s that cost going to be? Everyone is going to have to pay for it,” Cain said.

She said governments also pay for it. The only way for governments to pay for the higher minimum wage is to cut costs or raise taxes.

“We do not like raising taxes, but sometimes that’s inevitable,” Cain said.

Fire Tax Continues

Commissioners approved a resolution that implements the fire tax for the new budget year.

The special assessment on property is projected to raise $196,265 in revenue.

The vote was 4-1 to approve with Commissioner Rollin Hudson in opposition.

Fire Chief James Harris is using the money to hire three full-time paid firefighters. The additional firefighters will give Harris enough firefighters to keep a fire truck and firefighter in the city when the department is called to fight a fire in the unincorporated part of the county.

The fire tax is $129 per dwelling unit for residential, identical to the county; 5 cents per square foot for non-residential buildings; $8 for a vacant land parcel.

Government buildings are exempt from the tax along with churches and nonprofits. A 100 percent exemption can be granted to homesteaded properties when the owners meet the standard for extremely low poverty level income limits.

Cain said only one homeowner applied for the hardship exemption. Hudson said he is certain there are other homeowners who qualify for the exemption but didn’t apply.

When the fire tax was adopted, Mary Ellzey was city manager. The public was notified of the exemption in a legal advertisement published in a local newspaper. Cain said she doesn’t believe residents were told about the exemption with a notice on water bills as best she can recall.

City Election Coming

When qualifying ended recently for the upcoming Aug. 3 city election, Mayor Chris Jones and Weaver were re-elected without opposition.

The only names on the ballot will be those of Commissioner Rollin Hudson and his opponent Lawanda Jones.

City residents will vote at City Hall on Election Day.

Beauchamp & Edwards

The city’s accounting firm, Beauchamp and Edwards was rehired. The firm will increase its fees by $200 next year from $15,500 to $15,700.

Cain described the firm as extremely competent, helpful, and willing to work with city staff.

Lumpy, Bumpy NW 11th Drive

One of the ugliest and mud-hole-filled dirt streets anywhere in the greater Chiefland area is also one of the most important for future transportation in Chiefland.

Hudson said something needs to be done with NW 11th Drive to make it passable and to give delivery trucks using the new Pizza Hut/Kentucky Fried Chicken restaurants a place to turn around other than on U.S. 19.

Cain said the city has tried to purchase a piece of property from a private landowner to make it possible to pave the street, but two letters of inquiry haven’t been answered.

City Attorney Norm Fugate said the city commission needs to decide if wants to file a lawsuit against the property to take what it needs through eminent domain, the process of condemning property and taking it for a legal public purpose.

The street runs from behind Napa and the two restaurants all the way to U.S. 129.

Hudson said the street, despite its condition, will become increasingly essential for city residents to use as traffic increases on U.S. 19.

Hudson raised the issue under commission comments. The board wasn’t ready to take action on the non-agenda item.

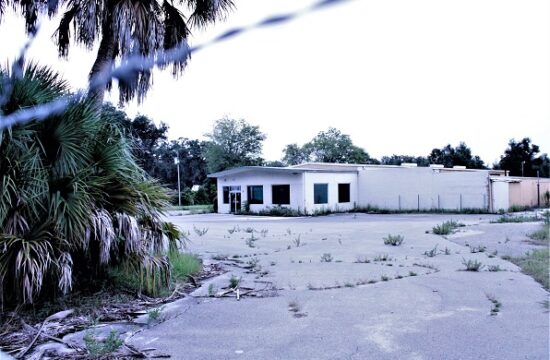

The new Pizza Hut and Kentucky Fried Chicken will operate from the same building. Across the highway, a new Popeye’s is being constructed where the former office building for Central Florida Electric Cooperative once stood.

———————-

City of Chiefland Regular Meeting June 28, 2021; Posted June 29, 2021