By Terry Witt – Spotlight Senior Reporter

When the Levy County Commission adopted its current budget in September of 2017 it was projected to spend $1.5 million more than it received in revenues over the course of the year, but it’s probably too early to say whether that dire prediction has come to pass.

The subject raised its ugly head at Tuesday’s county commission meeting when the commissioners were asked whether they would be holding a series of budget workshops to discuss spending in next year’s budget in light of the projected deficit for the current budget.

Board members voted 4-1 to set a proposed property millage at their regular board meeting on July 31. They plan to hold a budget workshop after the millage discussion. Commissioner Lilly Rooks urged the board to meet in the evening after people get off work but was outvoted.

The board must adopt a new budget by Sept. 30

Regarding the budget workshops, Commission Chairman John Meeks said the board usually gives groups, department heads, and constitutionally elected officers a chance to come and defend their budgets if they have a problem with the money allocated to them. But he didn’t say whether there would or wouldn’t be more public budget workshops.

“I don’t know what we’ll do. I’m sure at that point it will be some sort of combination of those we’ve done in the past. The budgets are supposed to be, being turned in, so we’re compiling the budget now. I’m sure there are people starting to get things cut out and their hair catches fire and they’re going to run down here for an explanation,” Meeks said.

“They are going to want to plead their case and then somewhere along the line the fire department shows up and other concerned groups show up; so in the past, we’ve been always pretty open to allowing people to speak when they have something to say about their budget.”

Clerk’s office finance director, Jared Blanton, who isn’t a county commission employee but works with County Coordinator Wilbur Dean in building board’s budget, said the commission will need several budget workshops over the summer months, particularly in June and July to hammer out the budget. He said he doesn’t care whether the workshops are attached to board meetings or held on a different date.

“Through the summer we are going to start having some workshops. I don’t have any projection about deficits this year for next year,” Blanton said.

Blanton said he had been optimistic about reducing deficits until he saw “some developments coming up that are making me less optimistic.” He didn’t say what he meant by developments.

Meeks said the county’s financial picture can be painted in different ways.

“Paint it however you want to. I can budget a billion dollars for this board meeting. If I spend 50 cents, what is my budget? What did I spend, 50 cents, not a billion dollars,” Meeks said.

Blanton said the county doesn’t always spend its entire budget and sometimes the deficits are less than expected.

“Even in the years when we budgeted a $4 ½ million deficit we only ran a $2 million deficit, Blanton said. “We’ve been running real deficits. Fiscal year 2017 was better.”

Meeks argued that the county is solvent.

“Well, we’re not writing out checks that are no good,” Meeks said. “We’re not defaulting on payment.”

Blanton said Meeks was right. He said if the county ever started bouncing checks he would probably have a heart attack.

Meeks suggested the county might have a million and a half dollars of cash left over when the budget year ends on Sept. 30. Leftover cash is called cash carry forward.

But Blanton said leftover cash can’t be budgeted to pay bills.

“With sound fiscal policy we shouldn’t budget recurring revenues from cash forward,” said Blanton, a Certified Public Account who once worked as an auditor in the private sector.

Blanton said cash forward is a cushion that could prevent the county from reaching the point where there is no money in the bank account.

“You don’t want to get recurring expenditures that are above recurring revenues because you’re going to exhaust your revenues at some point,” Blanton said. “That’s why we were spending down our reserves for a number of years because of recurring expenditures – actual check cutting – exceeded checks coming in and other sources coming in. I think we’ve stopped that for now. It looks like we’re in the black by a lot right now but we still have several months to spend.”

Meeks estimated that at least 20 Florida counties have had to borrow money to continue operating, but not Levy County.

“Paint the picture however you want. If you want to use gray and black paint and make it boohoo and sad, or you can paint it with bright colors and optimism that this board is making improvements. Paint the picture however you want. I like to use the whole palette.”

Dean said the county in recent years has cut departmental budgets or flat-lined them to prevent overspending, but he said there are always a few exceptions when additional expenses arise in a particular budget.

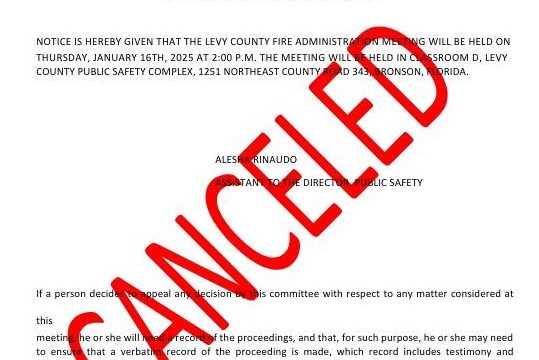

Board of County Commission Regular Meeting May 8. 2018

Posted May 10, 2018