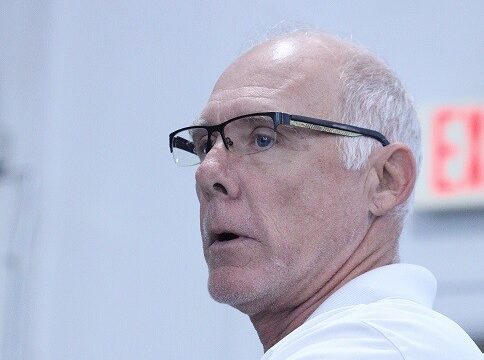

Jared Blanton, finance director for the clerk’s office and the budget officer for the county commission recommends a 9 mill property tax rate for the 2020-21 budget.

By Terry Witt – Spotlight Senior Reporter

Levy County Commissioners Tuesday approved a proposed budget of $98.8 million for next year and decided the property tax rate should remain at 9 mills.

Commissioners will consider giving tentative approval to the property tax millage at a public hearing on Sept. 8. The final millage and budget will be adopted at a Sept. 22 public hearing.

Commission budgets always start on Oct. 1 and end on Sept. 30 of the following year. The budget for next year is up about $9 million over the current spending plan.

Finance Director Jared Blanton said the board will carry forward $10.6 million of reserve cash into the new budget, but he said economic conditions will rob the county of 30 percent of its reserves by Sept 30, 2021.

EMS is expected to operate at a $759,000 loss unless commissioners make adjustments.

A final decision hasn’t been made on how high the EMS assessment might be raised to make up the deficit. Commissioners advertised a proposed rate of $171 per residence with the understanding the rate can come down before final adoption.

Commissioners haven’t reached a final agreement with the International Association of Firefighters, the public labor union that represents EMTs, paramedics, and firefighters in the Department of Public Safety. The final agreement will impact the EMS budget.

Property assessments for EMS, fire and landfill will be given final approval at the Sept. 8 public hearing. Fire and landfill assessments are expected to remain at current levels.

Blanton said there is much uncertainty about how much sales taxes, gas taxes and shared revenue with the state will drop over the coming year.

Many businesses continue to operate at half capacity due to state coronavirus restrictions. The partial closures reduce the amount of sales tax collected by the state. Florida state government lives off sales taxes. Services can be affected by lagging sales tax collections.

Bars, taverns and lounges, which generate a considerable amount of sales tax statewide, were shut down by the governor’s office in response to the coronavirus. Their employees are out of work.

Blanton said he doesn’t know how much property values will be impacted in the long run by the economic conditions. The county may not see those effects, if there are any, for a couple more years.

The coronavirus and the resulting shut down of the state and national economy is taking a bite out of the revenues that support local and state governments including the county commission and school board.

—————

Board of County Commission Budget Meeting August 4, 2020; Posted August 4, 2020