By Terry Witt – Spotlight Senior Reporter

Margaret M. Halada, a widow living in a mobile home in University Oaks near Bronson complained to Levy County Commissioners Tuesday that her property tax bill of $419.13 would cause a hardship, but Commission Chairman John Meeks said it wasn’t the board’s fault.

Meeks said the board did nothing to cause her tax bill to rise to that level and he said if her bill increased it was because her property values had risen and it wasn’t the board’s responsibility. The property appraiser’s office determines property values, not the county commission.

The property appraiser’s office determines values. That is true. But Halada’s taxable values barely increased from last year. In 2017 her property was valued at $33,701 for tax purposes. In 2018 her taxable values rose to $33,008, according to property appraiser records.

The difference in her bill this year was the special assessments that were levied by the county commission. The county commission adopted a $116 landfill assessment for the first time and increased the fire assessment by $39, which added about $155 in charges to her residential property tax bill over last year.

Commissioners are talking about raising the emergency medical service special assessment next year. They had originally planned to raise the EMS assessment at the same time they adopted the $116 landfill assessment and raised the fire assessment, but Commissioner Lilly Rooks said it was too much all at once.

Special assessments are technically not considered a tax under the law but the assessments appear on the annual property tax bill just the same, which allows the county to place a lien against the property if the assessments are not paid. The total tax bill is a mix of the ad valorem (property taxes) and special assessments added together. It’s difficult for many people to distinguish one form of taxation from the other. The difference is that ad valorem taxes are based on the value of the property. Special assessments are a flat fee.

Halada didn’t get hit as hard as many homeowners. She lives in a mobile home for one thing, which doesn’t have as much value as a standard home. The reason she didn’t receive a higher bill was because most of the value on her mobile home was forgiven on paper through the $25,000 Homestead Exemption she claims every year and through a $25,000 senior citizen exemption she claimed for the first time this year.

She was charged $119.88 for her real estate taxes in 2017, but because of the senior citizen exemption, the charge dropped to $55.15 in 2018. Halada’s total tax bill in 2017 was $328.88. Her bill rose this year to $419.13, almost entirely due to special assessments. School Board taxes increased less than $3 on Halada’s bill.

“You work all your life. I had a great job. I lost my husband. I have one income coming in and now this is going to cause me a hardship,” Halada said. “Who do I cry to next? The appraiser’s office sent me here and I’m not the only one.”

She came to the meeting with about six of her neighbors, all of them senior citizens. She said all her neighbors are complaining about higher property tax bills.

Meeks took time during the meeting to look at her bill. He noted that if she pays her taxes by Dec. 20 she gets a break on the price. She would pay $402.36 instead of $419.13. Meeks calculated the math. He said Halada would pay $33.50 per month in taxes if she pays early. He said that’s a reasonable charge for the amount of services it funds. He said he realizes it may be a hardship on some people with limited incomes. He apologized.

“Everyone in this county still expects more – the ambulance to be there whenever you call; the fire truck to show up, the sheriff to come whenever you call and need assistance. If you live on a maintained road – I don’t want to open that can of worms – but if you live on a maintained road and your road is maintained…whenever the mosquitos are bad you can call mosquito control; if you want to go to the library you can check out a book; if you want to go to a county park or launch a boat at a boat ramp those are provided for you.”

Meeks said the county commission provides many public services and someone has to pay the bill. He said the county adopted special assessments to require every property owner and homeowner to shoulder some of the cost of providing those services. He said the county adopted the landfill assessment to offset deficit spending at the facility many people call the county dump.

“I know that there are going to be folks like yourself that have limited income, that will suffer; I shouldn’t say suffer – pay a little more. But if we didn’t do something there was going to be a few that were paying a lot more,” Meeks said.

Assistant Property Appraiser Randy Rutter said he understands both sides. He said the Florida Legislature continues to add exemptions and revenue caps that take away money from county and city governments and yet those same governments have to provide the same level of services. He said counties across the state are approving special assessments to make up the difference. The assessments aren’t affected by property tax exemptions.

He said it is true that home and mobile home values in Levy County have risen by a total of 30 percent over the past three years, but the amount of value increase can vary quite a bit from one part of the county to another. The property appraiser’s office uses sales data to determine whether the assessed value of the property must increase. Rutter expects values to level off soon.

He said there are instances where an individual homeowner’s property’s values don’t increase much at all. He said Halada is a good example. But she is subject to the same special assessments as everyone else and so her tax bill increases. Rutter wasn’t present for the county commission meeting where Halada spoke but was asked by Spotlight to take a look at Halada’s bill to clear up the confusion.

Rutter said the state has created a very complex tax system that many people don’t understand.

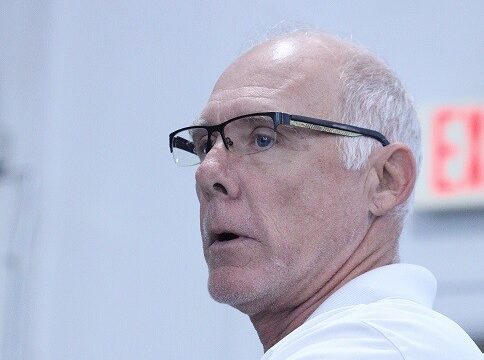

Photo by Terry Witt: County Commission Chairman John Meeks and Commissioner Lilly Rooks confer with resident Margaret Halada about the property tax bill she says is a hardship.

Board of County Commission Regular Meeting December 4, 2018

Posted December 6, 2018